Employment Law Update: New rates and limits for 2023 – 2024

April traditionally sees an annual increase in a number of statutory rates and limits relevant to employers and employees alike. The changes relate to the setting of minimum rates such as those for the National Minimum Wage and to statutory benefits like Statutory Sick Pay and the various statutory family-friendly payments. They also feed into the calculations used to value a number of different employment claims if successfully upheld by an Employment Tribunal.

We have set out below some of the main changes to note.

National Minimum Wage and National Living Wage

From 1 April 2023 to 31 March 2024, the following minimum rates of pay will apply:

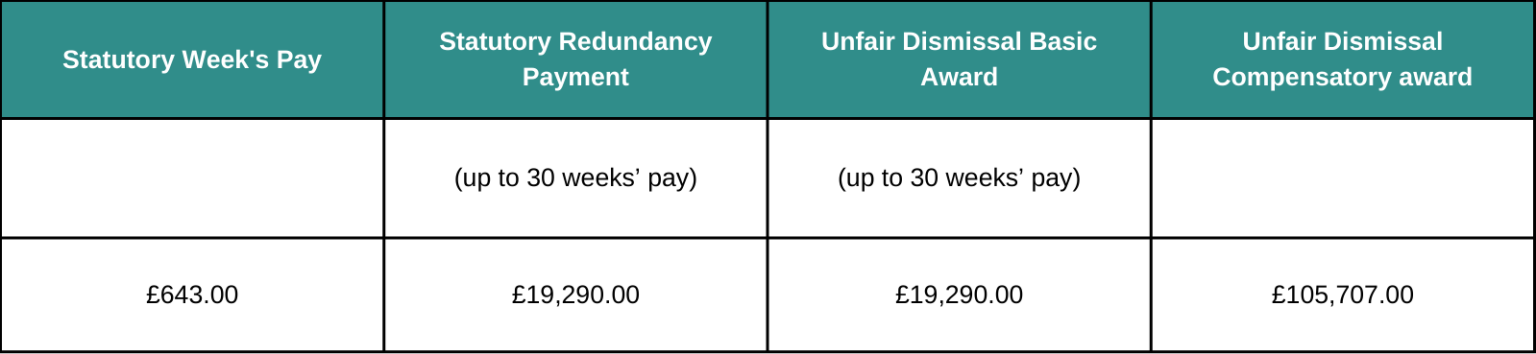

Weekly Pay

The value of a number of employment related claims are calculated by reference to a statutory ‘week’s pay’. The weekly pay is subject to a cap, which is set by the Secretary of State. The annual increase takes into account inflation measured by the Retail Price Index (RPI).

The cap on the weekly pay will increase to £643 from 6 April 2023. It is used in calculating claims such as the failure to give particulars of employment or breaching the right to be accompanied at a disciplinary/grievance hearing, but features in many more claims.

Compensation for Unfair Dismissal & Redundancy

Probably the most commonly known claims to which the statutory week’s pay relates to is unfair dismissal and statutory redundancy pay claims.

Compensation for unfair dismissal claims is split into ‘basic’ and ‘compensatory’ awards.

The basic award is calculated in the same way as statutory redundancy pay is, using a formula based on the employee’s age, length of service and a week’s pay capped at the prevailing statutory week’s pay. Whereas the compensatory award is calculated by reference to the claimant’s loss of earnings, subject to the annual statutory cap.

The calculation date is taken from the effective date of termination (EDT) of the contract of employment falling on or after 6 April 2023.

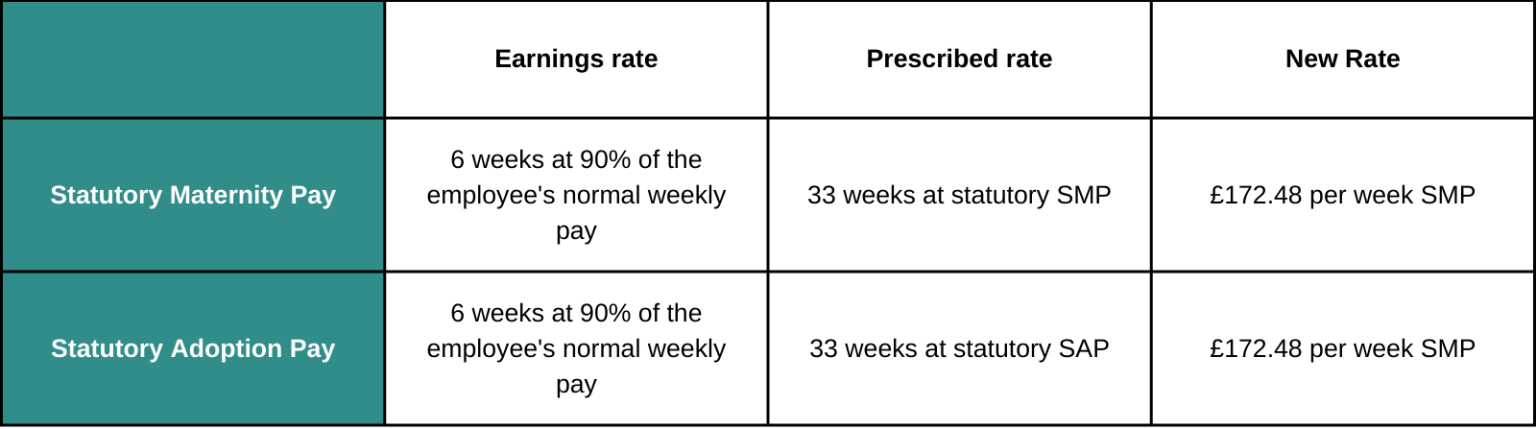

Statutory Family-related Pay

Statutory Maternity Pay (SMP) & Statutory Adoption Pay (SAP)

Both of these benefits are calculated and paid on a similar basis. Payment is payable in two parts, being the:

- Earnings rate – which is paid at 90% of the employee’s normal weekly pay

- Prescribed rate – the lower of either the current benefit rate (see – table below) or the earnings related rate (e.g. 90% of the employee’s normal weekly earnings)

It is the prescribed rate that changes annually. The rate change is effective from 3 April 2023.

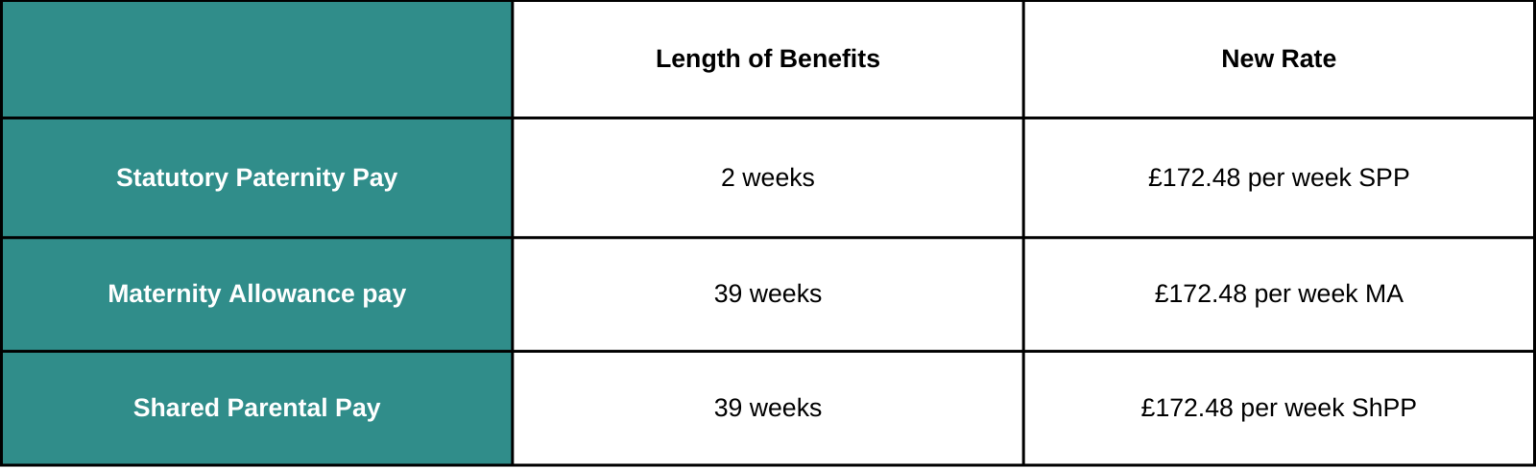

Statutory Paternity Pay (SPP), Maternity Allowance (MA) & Shared Parental Pay (ShPP)

All of these benefits are calculated and paid on a similar basis. Payment is again based on using the two parts – the earnings rate and prescribed rate.

For all, payment is determined on receiving the lower of either the:

- Earnings rate – (e.g. 90% of the employee’s normal weekly pay), or

- Prescribed rate – the benefit rate (see – table below)

Again it is the prescribed rate that changes annually. The rate change is effective from 3 April 2023.

Vento Guidelines

For discrimination cases, as well as compensation for financial losses, employees can also separately claim an award for injury to feelings in an employment tribunal.

For claims presented on or after 6th April 2023, the Vento bands are:

- A lower band of £1,100 to £11,200 (less serious cases);

- A middle band of £11,200 to £33,700 (cases that do not merit an award in the upper band); and,

- An upper band of £33,700 to £56,200 (the most serious cases), with the most exceptional cases capable of exceeding £56,200.

Other Updated Rates

Additionally, the rate of statutory sick pay (SSP) is also set to increase from £99.35 to £109.40 per week.

The minimum weekly amount an individual must earn to be entitled to these payments will remain at £123.

For any further guidance on this issue or any other employment law-related matter, please get in touch with a member of the Employment Team at Wilkes LLP. Alternatively, email us at [email protected].